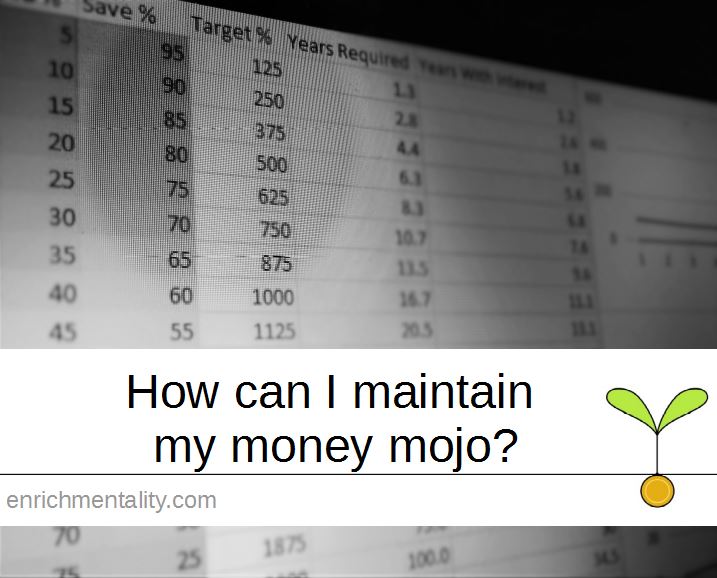

Saving for a huge goal – like a home deposit, or financial independence – or trying to pay off a large debt, like a mortgage or student loans – can seem impossibly enormous at times. All too often I hear people throw up their hands in defeat – ‘I’ll never pay it off anyway, so why bother?’

Quite apart from the psychological benefits of having smaller, more manageable debt even if no debt isn’t an option, there’s one very important reason – interest.

Anita Bell wrote a fantastic book called Your Mortgage: And how to pay it off in five years or less. For the new edition, she changed the title, and I think I can see why. Many people I recommended this book to were initially reluctant, believing they’d never pay their mortgage off in 5 years or less, so why try?

So maybe you can’t pay your home loan off in 5 years. But wouldn’t it be great to pay it off in 15? 25? On an average mortgage, this could save you hundreds of thousands of dollars in interest.

Even if you start out excited and motivated though, it can be difficult to keep this up.

There are a variety of tips and tricks I’ve come across over the years for maintaining my motivation when it comes to savings. I’m a very goal-oriented person, so these may work better for some people than for others, so just give the ones that appeal to you a go:

Continue reading “How can I maintain my money mojo?” →